Another week, another rollercoaster for the Rand!

South Africa’s much-anticipated budget presentation is finally behind us, but did it deliver the stability the markets craved? Meanwhile, global tensions are continuing to run high, with tariff wars, stock markets dropping, recession fears, and geopolitical uncertainty keeping the markets on their toes.

Somehow, through it all, the Rand managed to come out with its nose in front, buoyed by gold breaching the psychological $3,000 barrier...

Let’s break down what moved the markets and what’s coming next!

Market Pulse 📊

Key Moments (10-14 Mar 2025):

Some key headlines from the week:

- SA Budget Reaction: Finance Minister Enoch Godongwana presented the annual budget speech, proposing a 0.5% VAT increase, which faced pushback and sparked fiscal uncertainty.

- Gold Production Rebounds, But Mining & Manufacturing Struggle: Gold production increased 1% YoY, but mining and manufacturing remained weak, with a -2.7% YoY decline in mining and -3.3% YoY contraction in manufacturing.

- Gold Prices Surge: Gold hit breached $3000 as investors turned to safe-haven assets amid trade war fears.

- US Inflation Softens Slightly: Headline inflation eased to 2.8% YoY and PPI was flat—raising the likelihood of a Fed rate cut later in 2025.

Nervous Market Reverses on Budget

The Rand kicked off the week at R18.22/$ after the prior Friday's blowout...

...and was immediately under pressure, as the market pushed to hit a high of R18.37/$ before closing out the day around R18.33/$, as traders positioned themselves ahead of the budget presentation.

But what goes up must come down, and so it was with the ZAR...

...as it managed to recover nicely on Tuesday, pushing lower through the day and into after-hours trade to close at R18.17/$ as the US dollar took a hit after US stock markets entered their fourth week of sell-off following recent highs.

And then it was Budget Speech day...finally, after much division and infighting within the GNU!

And the Rand was immediately under pressure as it pushed all the way up to hit a high of R18.46/$ by lunchtime, with traders taking positions ahead of the Finance Minister's address.

It seemed there had been some compromise behind the scenes as the Budget came with some key fiscal adjustments, including a 0.5% VAT increase, with another planned for next fiscal year (instead of the originally proposed 2% increase)...with no tax bracket adjustments, which means tax payers will be paying more

...and a renewed commitment to cutting government spending by R50 billion over the next fiscal year...

Eish, how many times have we heard this before—and NOTHING happens?

As we said last week, we would love to see what a US DOGE-style audit would reveal in waste, fraud and abuse...

...much more than R50 billion, or what extra revenue the proposed VAT increase would bring in.

While across the ocean, inflation came in less at 2.8% YoY - less than expected and below the previous month's 3%, an encouraging sign overall.

Rand bulls seemed to take the all the news pretty well as the USDZAR initial pin-dropped to hit R18.26, rebounded but then fell over the balance of the trading session to close out the day around R18.31/$.

And in other news...

- 30-Day Ceasefire Proposal & Putin’s Response

Ukraine agreed with a US envoy to a 30-day ceasefire, with both sides expressing a willingness to explore long-term peace negotiations.

Russian President Vladimir Putin signalled support for the ceasefire but emphasised that the original causes of the conflict (including Ukraine's NATO aspirations) need be addressed to ensure a lasting peace deal.

With Russia gaining ground in the conflict, Putin voiced his concern that a ceasefire without a commitment to a permanent solution would not be in Russia's best interest, simply allowing Ukraine forces to regroup.

While tensions have eased slightly, uncertainty remains over the next phase of diplomatic discussions, which is expected to include a Trump-Putin call in the coming days.

Stock Markets Plunge!

Global stock markets experienced further weakness before a slight recovery, with some markets having seen a 10% correction since recent all-time highs, with investors fleeing risk assets as fears over economic slowdown and trade wars intensified.

Gold Hits $3,000 for the First Time

Gold soared past the $3,000 mark on Friday, touching a high of $3005, driven by safe-haven demand amid inflation concerns and global market uncertainty...

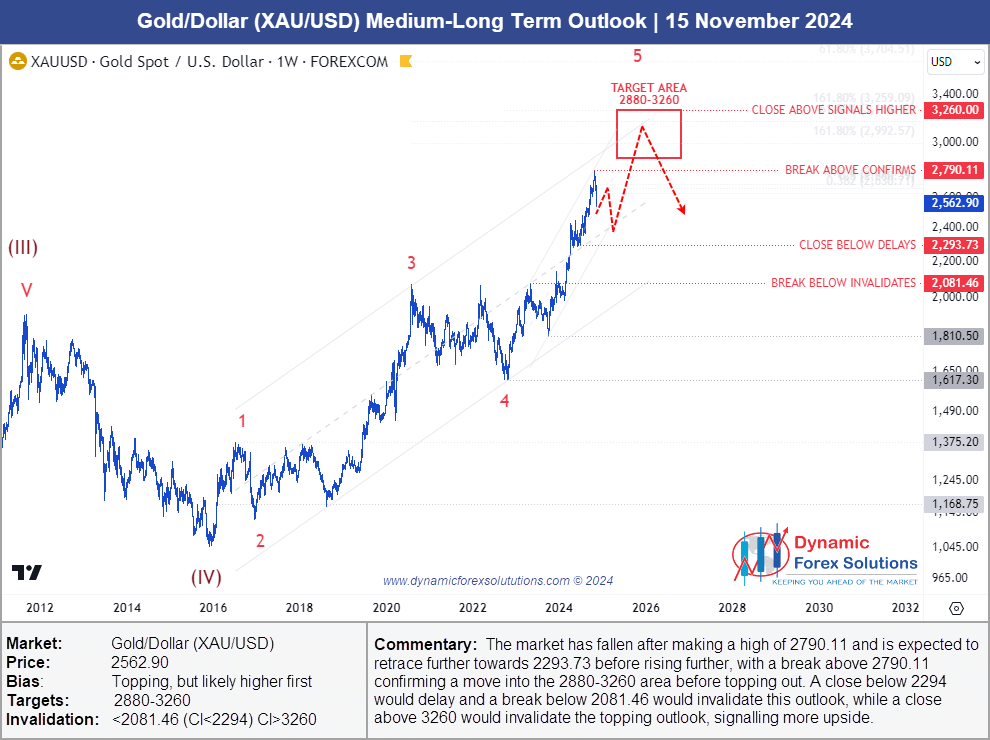

...which is something we had been predicting since November last year.

(click to enlarge)

Want to see where Gold (as well as Bitcoin, Dollar, & Euro) is headed?

Get our latest predictions here - 7 DAY FREE TRIAL

Rand Roars To End the Week Stronger...

Thursday was another humdinger for the Rand, as it was once again under pressure, as investors reacted to mixed mining production.

Gold production rebounded by 1% YoY, following a previous sharp decline of -8.4%, reflecting increased demand and a recovery in output.

However, mining output continued its downward trend, falling by -2.7% YoY, while manufacturing output contracted by -3.3% YoY, raising concerns about industrial activity.

The Rand punched higher to hit R18.43/$ but the Rand managed to recover nicely as it fell sharply lower to end the day at R18.27...

...bouyed by gold prices surging higher, closing in on the $3,000 per ounce mark...

...as well as US PPI came in flat at 0% MoM (also much lower than 0.3% expectations), which re-empasised a potential Fed rate cut.

And Friday for once belonged to the Rand...

...although it started off looking like it would be another blowout as the Rand pushed higher to hit R18.32 in early trade.

But that was as far as it got, as the USDZAR plunged lower to hit R18.13 before closing out around R18.16/$.

And then just to end the week with a bang, the new US administration continued to pile the pressure on Pretoria, as Ambassador to the US, Ebrahim Rasool, was advised that he was no longer welcome in the US...

...with US Secretary of State Marco Rubio branding Rahool as a 'race-baiting politician who hates America and its President' in a terse post late on Friday.

There are starting to be some serious implications for the South African government's anti-USA bias...

Volatility & Risk Analysis

A choppy but less volatility this past week:

- Average Daily Range: 19.6c or 1.1%

Equating to a potential profit/(loss) of R11,000 every day for every R1 million exposure - Weekly Range (total fluctuation): 32c or 1.8%...

...equating to a saving or loss of R18,000 for every R1 million exposure simply by taking action at the right or wrong time...

We would love to know: How are you managing these risks and exposures?

Want to understand how the market actually works

- and how to use this to advantage?

Download your

"Unpuzzling the Rand eBook" HERE ⇨

The Week Ahead

With multiple events on the horizon this week, the Rand is likely to continue to be volatile, with rate decisions locally as well as in the US and UK, likely to be the main triggers.

But geopolitical events will likely also Watch the budget presentation (if it still happens) and global data releases and geopolitical events closely...

...but don't expect them to give you market direction!

For that, you need a scientific-based forward-looking objective view - like the one above!

Until next time, trade wisely!

To give you a little helping hand, feel free to take our Rand forecasting service for a test-drive!

This will give you access to the same charts that help guide us and our clients with the likely direction of the Rand - ahead of time, enabling us to make educated and informed decisions.

Simply use the link below to get access now.

No charge. No card. All yours to try out for 14 days.

If you have any questions or feedback, please leave them below.

To your success~

James Paynter

P.S. Worrying about how to in manage your Rand exposures this year? Email me or give me a call on (041) 373-6310 or (087) 551 2848 - we would love to help.

P.S. Enjoyed this Weekly Rand Review? Click here to get our Weekly Rand Rev