And welcome to some new insights for our Rand enthusiasts!

Another week has come and gone - and almost a month.

From gold prices smashing records to the Rand showing some backbone before eventually caving amid trade war jitters, it’s been a volatile one.

Let’s dive into the highlights and make sense of what’s been moving the ZAR and global markets over the past week.

Market Pulse 📊

- Price Action: R18.10-18.44 range, as Rand again suffered on Friday

- Technical Setup: Support R18.27/18.10/18.00, resistance R18.45, 18.50 18.60

- Momentum: Rand weakness bias

Key Moments (24-28 Mar 2025):

Some of the more critical factors affecting price action this week:

- Gold Hits New Highs Record: Safe-haven frenzy intensifies as global uncertainty pushes precious metals

- Russia/Ukraine Partial Ceasefire: US envoys seemed to have negotiated a partial ceasefire on the way to negotiating a lasting solution.

- Rand Weakens on Global Trade Tensions: Emerging market currencies buckled as risk aversion takes hold.

The Rand kicked off Monday trading at R18.16/$, showing some initial resilience as markets digested the weekend news.

US Manufacturing PMI came in stronger than expected at 52.1, which gave the Dollar a bit of a boost, pushing our local currency to a high of R18.25 before closing at R18.24/$.

Tuesday was a holding pattern day, with the USDZAR barely moving as conflicting signals kept traders cautious. US Consumer Confidence dipped to 104.3 (vs expected 105.0), which would normally favor the Rand, but trade jitters kept a lid on any meaningful gains, as it closed pretty much where it opened.

And it seemed we were in for a really quiet week as Wednesday came and went with the smallest daily range of just 8.9 cents (0.5%) as the market continued its wait-and-see mode.

But while everyone was looking for some news or event to give some direction, we had our eyes firmly on what the charts themselves had told us...

...using our proprietary combination of Elliott Wave, cycle analysis, time and price ratios and relationships and momentum studies.

And that picture was clear (see below).

(click to enlarge)

As long as we held above the recent low of 17.9884 (no lower than 17 8645), the market was expected to thrust strongly above R18.4300...

...all it needed was some trigger!

And in other news...

Russia and Ukraine Agree to Partial Ceasefire

A US-brokered agreement has led to a limited ceasefire focused on halting attacks on energy infrastructure and ensuring safe operations in the Black Sea, amid allegations of violations from both sides, and its full implementation remains uncertain due to disagreements over conditions.

It seems we are slowly taking steps towards a more lasting solution, and it seems there is a readiness for this, but there remain many challenges.

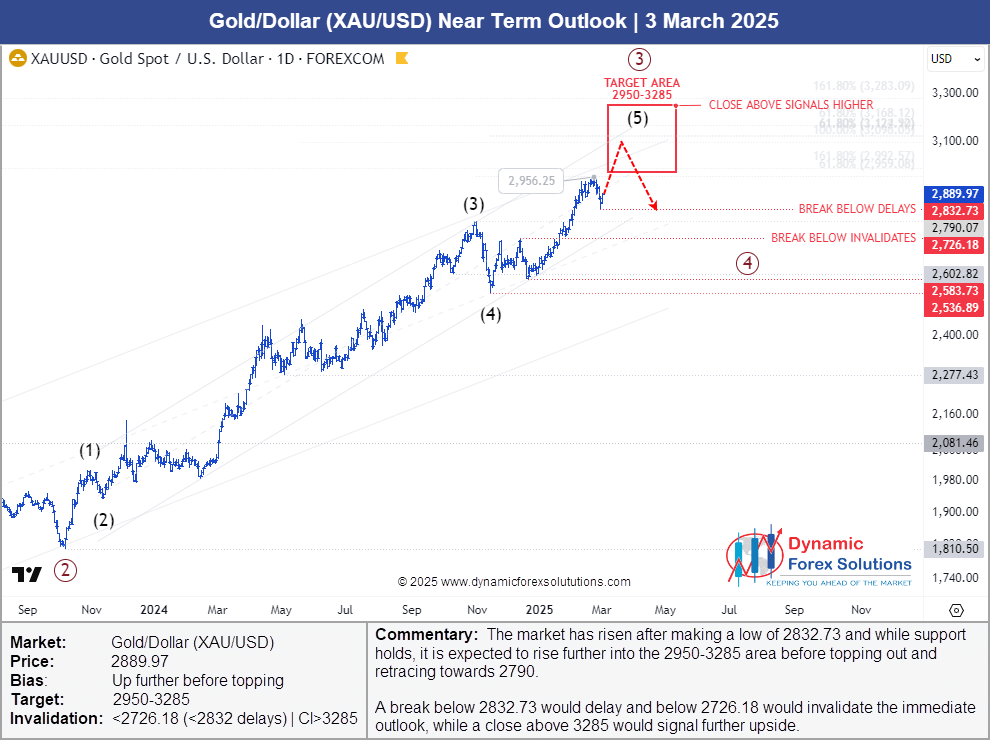

Gold Hits New All-time High

Gold continued to shine, pushing to new highs as it closed in on breaching $3100, with traders continuing see the precious metal as a safe haven amid ongoing global tensions and escalating tariff wars.

What is interesting is this is exactly what we were expecting when Gold had dropped after making a high of 2956 in February, as can be seen below.

(click to enlarge)

Want to see where the Dollar, Euro, Gold & Bitcoin are expected to go?

Get our latest predictions here - 7 DAY FREE TRIAL

Getting back to the Rand - and our anticipated thrust higher...

Thursday seemed to show signs of a breakout as the markets pushed up to hit R18.34 in afternoon trade, but then US GDP Figures came in at 2.4%, slightly higher than expected...

...which should have been Rand bearish, but instead the market reversed sharply to close out the day firmly back in the range just above R18.20/$...

And then enter Friday...

And wow, what a humdinger of a day...

...as the market pushed higher to test R18.27 in early trade but then reversed sharply during the SAS trading morning as it tested below R18.15 several times...

...and it seemed like our forecast was not going to work out as we expected...

But then came the budget balance surprise that showed a surplus of R24.22bn...

...which should have been Rand positive, but instead was the exact opposite!

The Rand tanked, losing 25 cents in just an hour...

...touching R18.44 before managing to recover slightly to close out the week a couple of cents before closing out the week around R18.40/$.

And this coming at the same time as Gold had surged to new highs, which should have been Rand positive.

Which once again highlights just how unreliable rational thinking or conventional wisdom are when it comes to the markets...

...because the markets are not rational at all!

In fact, they so irrational, it's almost predictable 😁!

Which, when you know in what way, can make you anticipate the most unlikely moves!

As we did this past week...

...fascinating stuff, isn't it?

-

And rewarding too, when you are one step ahead!

And so came an end to another pulsating week!

Volatility & Risk Analysis

Daily volatility was low, but weekly higher with Fridays' jump of 35 cents:

- Average Daily Range: 17.3c or 1.0%

This equates to a potential profit or loss of R10,000 every day for every R1 million exposure - Weekly Range (total fluctuation): 35c or 1.9%...

...equating to a saving or loss of R19,000 for every R1 million exposure simply by taking action at the right or wrong time...

Although this was less volatility than we have seen...

...as can be seen above, these are still significant risks - for gains and losses - and some very sudden ones!

The question is:- Did you manage to take action in time?

Want to understand how the market actually works

- and how to use this to advantage?

Download your

"Unpuzzling the Rand eBook" HERE ⇨

The Week Ahead

And with March already over, we are already galloping into the 2nd Quarter!

We have a few potential big triggers this week, the Quarterly Bulletin being one locally and of course Non-farm Payrolls on Friday.

And then, we have Trump's tariffs coming into effect as well, and potentially more happening on the trade war front to keep the pot bubbling.

Where does this leave the Rand?

Let's forget the noise and instead continue to look to what the charts and sentiment cycles themselves are telling us...

...I recommend you do the same!

To give you a little helping hand, feel free to take our Rand forecasting service for a test-drive!

This will give you access to the same charts that help guide us and our clients with the likely direction of the Rand - ahead of time, enabling us to make educated and informed decisions.

Simply use the link below to get access now.

No charge. No card. All yours to try out for 14 days.

If you have any questions or feedback, please leave them below.

To your success~

James Paynter

P.S. Worrying about how to in manage your Rand exposures this year? Email me or give me a call on (041) 373-6310 or (087) 551 2848 - we would love to help.

P.S. Enjoyed this Weekly Rand Review? Click here to get our Weekly Rand Rev