A warm welcome to our first Weekly Rand Review of the year.

We take this opportunity to wish you a healthy and prosperous 2024...

...and look forward to keeping you ahead of the curve when it comes to navigating the Rand and other global markets.

The year has certainly started with a bang, with the markets having to ride some pretty choppy waves of global news, local drama...and even some crypto action. And somehow, despite all the turbulence, the Rand has managed to keep its balance to see out the week on the level...

...while still holding onto the gains it made since last week's brief flurry to R19.96/$.

So, without further ado, let's delve into some of the factors that affected the Rand and other markets of interest this past week or so...

Key Moments (8-12 Jan 2024)

Here are some of the more significant news highlights from the past several days:

- Election Year Maneuvers: This year sees elections in over 50 countries, including locally and in the US - so expect it to be a year of political jostling...with potential triggers for some big moves.

- SA’s Risky Play at the ICJ: South Africa is taking on Israel at the ICJ with some serious accusations, which could impact on its international relations.

- AGOA Extension Approval: According to reports, the US is thinking of extending AGOA for another decade. This could be huge for exports and might just give the Rand a nice little boost...but don't celebrate too soon!

After the previous week's gyrations (which ended with the market flirting close to R19/$ before reversing over 35c late on Friday after the US Nonfarm Payrolls release), the Rand opened the week around R18.65 in early trade...

...but was soon back up to testing R18.80/$...

...before falling sharply again to hit R18.54/$ in after-hour US trade. So a bit of a jittery start for what is expected to be a jittery year, especially from a political perspective, with over 50 countries going to the polls in 2024...

...with two of the critical ones, of course, being:

Firstly, domestically, where the ANC are doing everything they can to re-ignite its dwindling support (while at the same time trying to rush through its socialist-flavoured legislation).

And secondly, and more importantly, in the US, where it is looking increasingly likely that it will be a Trump vs Biden re-run (plus a Kennedy in the mix), with plenty at stake as the economy stutters, debt continues to escalate out of control...and tens of thousands of illegals continue to pour across the Mexican border.

Election years are always full of shocks and triggers...

...expect no different this time round!

Getting back to the Rand, after opening SA trade on Tuesday around R18.62/$ it continued to bounce around in a range, testing R18.75/$ early Wednesday.

...before pulling back to around R18.60, as it continued to look for some direction ahead of US inflation data.

Then we had some big news late on Wednesday on the crypto-currency front.

In a much-anticipated move, the U.S. Securities and Exchange Commission (SEC) approved the applications of 11 spot Bitcoin ETFs, which is a significant step in broadening access to Bitcoin for investors globally. This approval now permits the ETFs to be listed on public stock exchanges, giving investors direct exposure to Bitcoin's price movements without needing to buy or hold the cryptocurrency directly.

This development could have implications for the cryptocurrency market and potentially influence investor sentiment globally, including markets connected to the Rand. Following the news, on Thursday Bitcoin spiked to hit a new 2-year high of $49048 - before falling sharply...

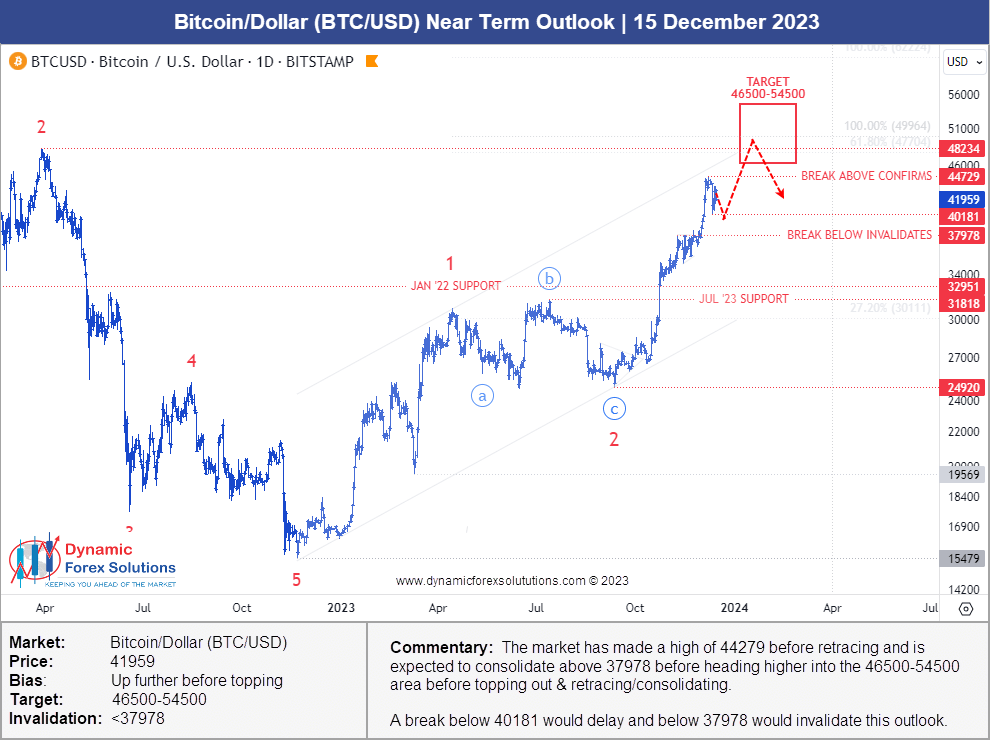

...which is exactly what we were anticipating, as can be seen from our near-term forecast issued back on 15 December 2023 (see below)...

Isn't it fascinating how financial markets move?

And how news just provides the trigger for sentiment to take the market where it was going to go anyway!

US Dollar, Euro, Gold and Bitcoin, get subscribed here.

And then, in other major international news, farmers in Germany kicked off a week of the biggest protests in decades against the government’s proposed cuts to agricultural subsidies, with highway shutdowns and city center demonstrations taking place throughout the country.

Following increasing pressure being brought to bear on the European farming sector in the last few years amidst the 'climate change' agenda nonsense, German farmers seem to be making their voices and frustrations heard in no uncertain terms. Coupled with a railway workers strike (and a potential doctors strike), this has brought the country to a virtual standstill, putting significant pressure on the government as to how to deal with the hot potato in its hands.

It will be interesting how this all pans out...

...but one thing's for sure - if there is one sector any country needs, it is the farming sector - just ask Zimbabwe!

Getting back to the local currency, it continued to range trade in the latter half of the week losing about 17c on Thursday afternoon following US inflation coming out slightly worse than anticipated...

...before clawing back ground to open local trade on Friday back around R18.60 against the greenback.

Amidst all this, one of the headlines that pervaded the latter half of the week was the International Court of Justice (ICJ) hearing of South Africa's case against Israel (filed late December last year), where it has charged Israel with 'genocidal acts' against Palestinians in the ongoing conflict with Hamas in Gaza.

The ICJ is expected to make a ruling soon following the two-day hearing...

...but either way, this could have some major impact on international relations for South Africa going forward...

And then, in other important news that could impact on SA's economy and trade relations going forward...

....it appears from reports that the US has reached preliminary agreement with more than 30 African nations to extend their preferential trade access under the African Growth & Opportunities Act (AGOA) - scheduled to expire in September 2025 - by another decade. While this looks positive for the local economy, this decision is, of course, pending approval by US Congress, which currently has a Bill (H.R.-145) calling for a thorough review of the U.S.-South Africa relationship...

...which could potentially lead to South Africa's expulsion from the program, which would be extremely damaging.

We will need to be watching this one closely.

Amidst all this news coming out, on Friday, the Rand seemed pretty much unfazed as it continued to hold onto its gains from the previous week...

...to close out the week in the mid R18.60s - pretty much where it started it.

And that's the wrap!

holds-onto-gains-vs-Dollar-but-where-to-next_20240112.png)

The Week Ahead (15-19 January 2024)

With a US holiday today, and not much on the economic calendar, here's what we'll be eyeing up over the next five days:

- EU/UK: UK inflation, Retail Sales

- US: Retails Sales, Housing Starts, Jobless Claims

With the Rand having trod water the past week, one thing is for sure -

...don't expect the Rand to be so docile for the rest of the month!

But which way will it break out?

We will keep looking to our trusted proprietary forecasting system give us a heads-up on the way ahead...

...and if our recent updates for the next few days, weeks and months ahead are anything to go by, we could have some ride ahead of us this year!

Flying blind can be costly in this market - you need to fly by instruments, not gut feel.

Hit the link below to get access to our latest predictions.

Until we meet again, safe trading!

Please take our Rand forecasting service for a test-drive!

This will give you access to the same charts we are to give us and our clients the likely direction of the Rand - ahead of time, enabling you to make educated and informed decision.

Simply use the link below to get access now. No charge. No card. All yours to trial for 14 days.

(You don't want to regret not having done so this time next week...)

If you have any questions or feedback, please leave them below.

To your success~

James Paynter

P.S. Enjoyed this Weekly Rand Review? Click here to get our Weekly Rand Review in your inbox every Monday