Another week of intriguing market activity, but it was largely sideways when it came to the Rand vs Dollar, Euro and Pound.

Perhaps some respite was welcome for most after the frantic last few months...

Despite the lack of clear market movement, the Rand held its ground around the best levels since the March collapse.

And there was news aplenty, with a mix of local and global events.

So let's get into the full review - and then take a peak at the future too.

Here were some of the biggest headlines from the 5 days:

- More Vaccine News - it is now not just one company that is breaking out ahead in the race to a vaccine, but two, as Moderna also seems to be almost ready to get FDA approval. Is the end in sight?

- Bitcoin Boom - the major crypto pole-vaulted to its highest level since 2017, breaking to more than $18,000 - how much further will it go?

- Investment Drive - Ramaphosa's ambition plans for investment seem to be paying off following his third investment conference

- Lockdown 2.0 - that is the worldwide question right now, as country after country begins the second wave...

- US Election Drama - although called by the mainstream press, the US election outcome continues to remain uncertain amidst multiple legal challenges

So when the Rand opened around R15.45, all eyes were watching to see if this was going to be another week of Rand strength, or if the move would run out of puff.

But right from the outset, the Rand pushed stronger, testing R15.27 late on Monday evening's trade.

This was after the next big news - Moderna announced that they were about to apply for FDA approval, after also conducting tests on their vaccine with a more than 94% success rate in early analysis.

Between Pfizer's vaccine and now Moderna announcing similar results, stock markets soared!

The Dow Jones Index a new high just short of 30,000 points as many saw this as the answer to months of lockdowns.

But was it that simple?

Well, current case counts wouldn't indicate that as the US cases continue to climb exponentially, with November 13th seeing a record of more than 180,000 cases reported in the US in a single day. This was prompting states like New York to close all schools again.

Could global economies endure another shutdown?

Economies like China's are only just recovering with consumer spending starting to pick up once again.

Around the world, the story is the same with the UK in their second lockdown. Japan also saw another outbreak increasing, particularly in Tokyo. Other countries battled the same problems.

Getting back to the US, many have not recovered from the first lockdown - as Mitch McMonnell the Senate majority leader agreed to restart talks for more stimulus.

This was more big news for the stock markets and US Dollar, as stimulus being approved now is much more likely than before the election, where it was just a game of politics for both sides.

While stimulating the economy and helping those in need is critical, the fact of the matter is that any new stimulus package is just creating a bigger debt problem down the road - something the US cannot afford...

But it is critical too that the US economy needs to get back to normality, as it has such an effect globally.

And then of course, we have the US election drama that continues to unfold, with the mainstream press having called the race for Biden, and both candidates claiming they have won.

The fact is, the election outcome continues to remain unclear amidst recounts, audits, irregularities, anomalies and claims of widespread fraud in the 6 battleground states - and multiple legal challenges (and more likely coming) that could well end up in the US Supreme Court.

Until all these are resolved, and the Electoral College votes, there will be no president-elect.

So we will have to wait and watch to see what happens on the US side of the pond...!

Expect some interesting weeks ahead - which will keep the markets edgy and volatile.

As for the Rand though, it never did break stronger than it's Monday levels, as we slowly tracked weaker again:

The following few days saw a sharp move weaker again, touching R15.70/$.

Back to the US, most news stations extended Joe Biden electoral college lead, with only Georgia and North Carolina remaining to be called..

Georgia is undergoing a recount, while it appears NC will fall into Trump's hands.

But as mentioned, the show is far from over, with mounting disputes and legal challenges to election results in Michigan, Pennsylvania, Arizona and possibly Nevada and Wisconsin.

So don't hold your breath.

Expect this to end up in the US Supreme Court before a US President is elected (remember George W Bush and Al Gore in 2000)...

An interesting few weeks lie ahead.

And then in other news:

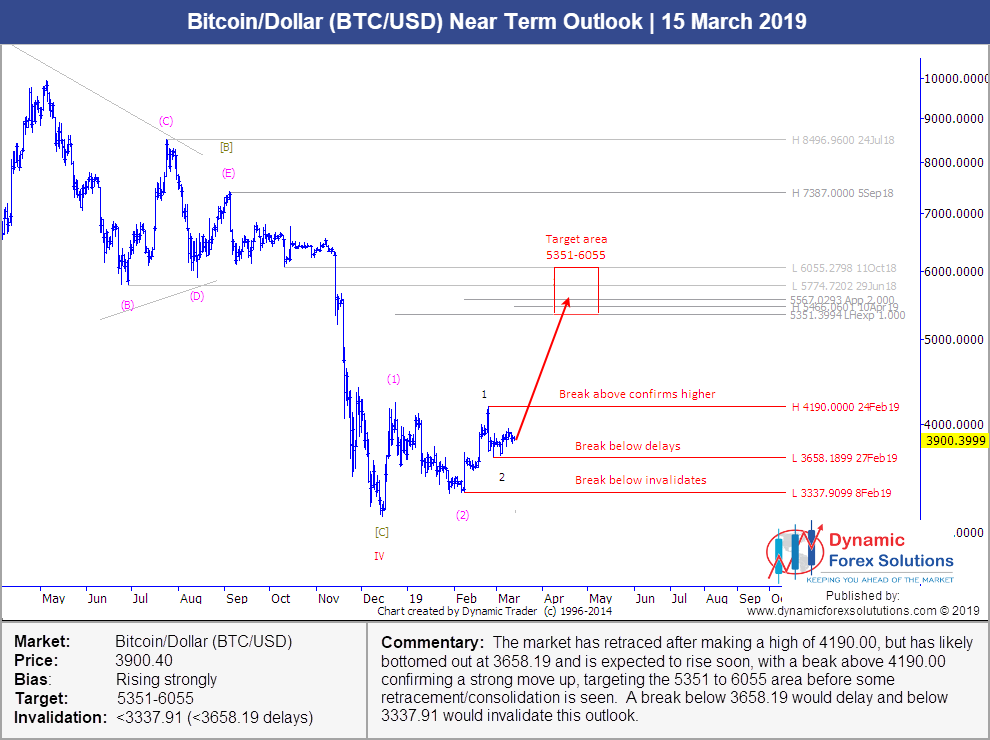

- Another market which also does not ever cease to amaze is the one and only Bitcoin - the world's most popular and famous cryptocurrency. Since December 2017 when we saw the amazing push over $20,000 which ended in a crash (which we predicted here), many had written the market off as a fad when we saw lows of $3000 odd in 2019.

- Looking east, Japan reported a jump in Q3 GDP of 5.0% while China's October industrial production was up 6.9%, both above expectations. Will this hold as second waves come on in places like Japan?

- Locally, insurance disputes have been central to the current pandemic crisis - particularly in SA, where it was to be ruled whether business interruption losses during the lockdown was applicable to insurance claims, with Sanlam arguing that it was government enforced - not that the pandemic actually caused the losses. This last week, the court ruled against Sanlam, ordering them to pay back losses and the applicant's legal costs. This is going to shake up the insurance landscape across SA, with the precedent set for other businesses to do the same! Watch this space!

- One of Ramaphosa's mine drives as president has been to try and increase investment - something that he has succeeded in doing so far. This year was probably the most the most difficult there has ever been to find investment...yet he did it again! Another 50 investments and R110bn was pledged at the third investment conference, as SA remained on track to hit the R1.2 trillion target over the 5 years.

Well, this week Bitcoin proved them wrong with a move back over $18,000, even nearing $19,000 on Friday. We also have been calling this move to these levels, as we actually called the market's bottom back in March 2019… did you know that we forecasted Bitcoin? You can get access to our predictions over here. Below is an example of the forecasts we release, this one being the March 2019 one mentioned above (click to enlarge):

Getting back to the Rand, Thursday and Friday saw the Rand remaining rangebound, but still testing the bottom (strong) side of that Range around R15.30/$ and beneath before weakening in late trade.

It had been quite a week!

The Week Ahead (23-27 November 2020) |

As we head into the new week, there are some potential economic releases which could provide triggers, with the below being some of the main ones

- SA - Inflation Rate

- USA - Jobless Claims, GDP, Durable Goods Orders, FOMC Minutes, Trade Balance

- EU - Consumer Price Index

But all eyes will likely remain on potential lockdowns globally.

And then, of course, the US election results. As mentioned above, the show is far from over here, and an intriguing few weeks lie ahead before a victor is announced.

As for the Rand, expect plenty volatility once again. We will keep looking at our Elliott Wave based forecasting system to give us some clues, with two key levels that we will be watching to confirm our larger degree trends.

Another interesting week lies ahead!

Please take our Rand forecasting service for a test-drive!

This will give you access to the same charts we are to give us and our clients the likely direction of the Rand - ahead of time, enabling you to make educated and informed decision.

Simply use the link below to get access now. No charge. No card. All yours to trial for 14 days.

(You don't want to regret not having done so this time next week...)

Look forward to hearing from you.

To your success~

James Paynter