And welcome to another update of our Weekly Rand insights!

What a week of contrasts!

While local unemployment data provided a rare bright spot, global market jitters and Fed Chair Powell's hawkish stance kept the pressure firmly on our currency. The Rand tracked steadily weaker despite some positive domestic news, proving once again that global factors often trump local fundamentals.

This week brought us the first unemployment drop in a year, disappointing manufacturing numbers, and enough Fed-speak to keep traders glued to their screens. Through it all, post-election uncertainties continued to cast their shadow.

Let's dive into some of the detail...

Key Moments (11-15 Nov 2024):

Some of the more pertinent headlines and events over the past week:

- Jobs Surprise: Unemployment drops to 32.1% from 33.5%

- Manufacturing & Mining Blues: Production and mining disappoints

- Powell Pushes Back: Fed chair maintains hawkish stance

- Crypto Booms: Bitcoin and Alt-coins Spike Post-Election

Monday: Post-Election Pressure

The week kicked off with the Rand opening at R17.60/$, after having managed to gain back some ground in the latter half of the previous week after the post-election spike.

But if our forecast from the previous Friday was to be believed, we were in for a bit of a surprise if we thought the Rand's woes were over. As can be seen below, we were expecting a move at least into the 17.89-18.10 area in the coming days, with a break above 18.10 signalling more upside.

(enlarge here)

And it wasn't long before market global forces took control.

By midday, we'd pushed up to R17.74/$...

...and the afternoon brought no relief as we touched R17.98/$ before closing at R17.91/$ - already validating our forecast of the day prior.

And a sign of things to come.

Tuesday: Another Nervous Choppy Day

Opening the day R17.90/$, the Rand lost ground from the word go, pushing above R18.00 before the SA desks had opened...

...and had touched R18.10/$ by the time encouraging news came thought that unemployment had dropped from 33.5% to 32.1% - the first decrease since Q3 2003...

...but all this caused was a slight pullback in the market before pushing higher to touch R18.17/$ before managing to settle around R18.08 at the close, as the markets continued to feel the heat of a resurgent US dollar following the US election results...

...with the Rand also not benefitting from the news that Manufacturing Production had shrunk by 0.8% year-on-year in September, the second month of negative growth...

Wednesday: US Inflation Triggers More Pressure

Finally, it seemed the Rand was finding some fight as the market pulled back sharply below R18/$ to hit a low of R17.94 to the Dollar by midday...

...but that is the best it was going to get as the US inflation data releases seemed to provide a trigger, despite this being in line with expectations of 2.6% year-on-year (up from 2.4% previous)...

...which once again highlight just how irrational these market moves are, and how news is merely a trigger for where sentiment is going to take the market.

Anyway, the market reacted...

...and the US Dollar index jumped strongly higher - with emerging markets being caught in the slipstream. The Rand wasn't spared, rocketing to R18.27/$ before managing to claw back some ground to around R18.19/$ as the midweek closed

Crypto Markets Celebrate Trump Win

And then, in other news:

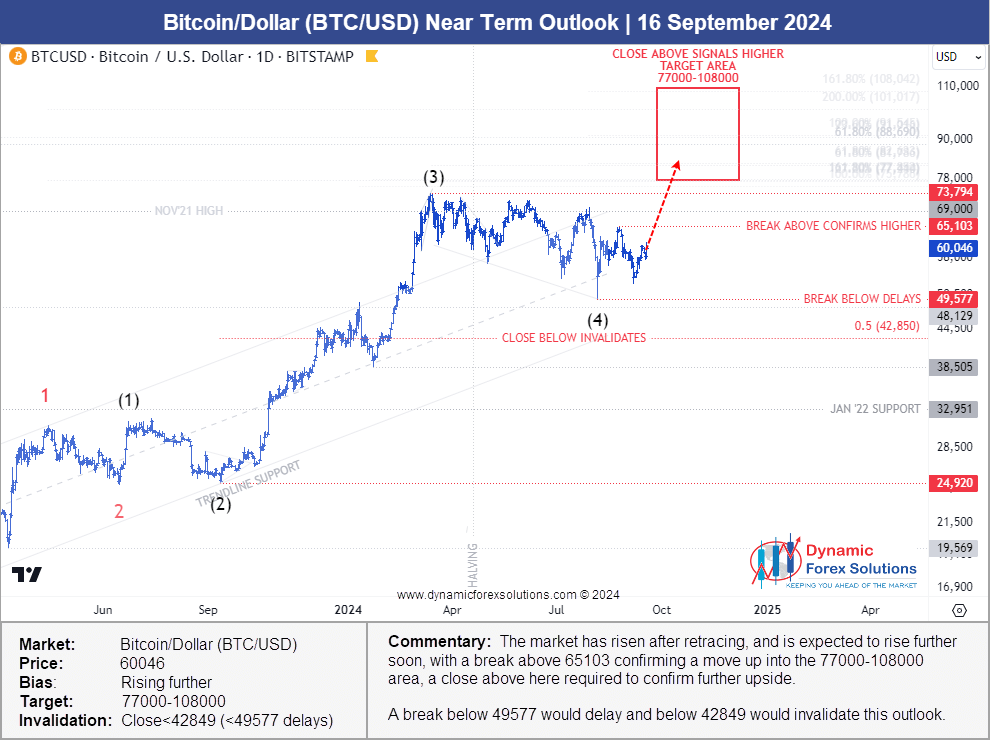

Bitcoin and other some other cryptocurrency markets have surged in the wake of Trump's landslide election, with the crypto sector expecting a dramatic change in the crypto landscape in the coming Trump administration.

Trump has in recent months voiced his opposition to CBDCs (central bank digital currencies), promised to make a Bitcoin part of the US strategic reserve, has supported mining in the US, pushing for the US to be the crypto capital of the world.

And Trump has promised to fire SEC chairman Gary Gensler, who has been in charge of a war against crypto companies, most notably Ripple, with the 4 year court case now in the appeal stage, following a ruling in favour of Ripple and its XRP coin not being regarded as a security for non-institutional sales.

Bitcoin's price has risen by over a third, as it almost touched $95,000 last week...

...while XRP has catapulted higher, pushing to 1.20 per dollar after hanging around 50c for a considerable time...

...only being outdone by DOGE, a meme coin that Elon Musk has been toting for qute some time, and which ironically is now the acronym for the Department Of Government Efficiency, which he will be heading up to drastically trim the US federal departments in size and expenditure in the coming administration.

If many were surprised by this push to new highs by Bitcoin, we have been anticipating this move, as can be seen by our forecast in September, when we were forecasting a push into the 77000-108000 area the next few weeks

(click to enlarge)

Which is exactly what we have seen...

...and further, we have been expecting a move up to $95,000 ever since January 2023 when Bitcoin had just made a low of $15,479...

Want to see where Bitcoin, the Dollar, Euro and Gold are headed now?

Get our latest predictions here - 7 day free trial

Thursday: Powell Piles In

Morning trade opened at R18.19/$, but again was soon under pressure as the Rand spiked still higher, homing in on R18.40 by midday...

...this coming amid mixed signals locally from the mining sector, with Gold Production down 3.7% while Mining Production showed in 4.7% increase since last year.

The Rand seemed to finally find some strength to stop the rot as it pulled back sharply to below R18.20 ahead of Powell's speech before closing out around R18.23/$.

In summary, Powell indicated he was not in a rush to cut rates, pointing to growth figures as well as inflation moving steadily down towards the 2% target, despite the recent uptick.

Friday: Rand Finding Some Support

Finally, a day of relative calm to end the week.

Opening at R18.23/$, we saw the Rand steadily improving through the morning, touching R18.13/$ as some risk appetite returned to markets...

...before closing closing out the week around R18.15/$ to round off a week that will not be remembered as one of the Rand's better ones!

But this was not one that was unexpected for those on the inside track!

Volatility & Risk Analysis

So what did such a volatile week mean for you in terms of your forex risk?

- The Average Daily Range was 28.8c or 1.61% - which means that for every R1 million exposure the daily fluctuation (potential profit or loss) on average was R28,800 every day

- The Weekly Range (total fluctuation) from the lowest point (R17.59/$) to the highest (R18.39/$) was a whopping 80c or 4.55%. This means by taking action at the right time you could have saved or lost R80,000 for every R1 million exposure...

For anyone exposed to Rand forex, this is a massive risk.

In order to manage this risk, you need to understand how the markets work, and have an objective system for timing your hedging and conversions to enable you to:

- Mitigate potential losses and

- Take advantage of favorable market movements.

Want to understand how the market actually works

- and how to use this to advantage?

Download your

"Unpuzzling the Rand eBook" HERE =>

The Week Ahead

Monday dawned with geopolitical tensions having increased dramatically following reports that Ukraine have being given the go-ahead by Joe Biden to use US-made long-range missiles to strike deep into Russian territory...

...something which Putin has clearly said would put NATO in a direct war with Russia, and that Russia would be forced to take "appropriate measures" with nuclear weapons not being ruled out.

With Trump having vowed to put an end to the war on day one, and Putin having stated in the past few days that he is ready to do so, this move is a dangerous escalation towards WWIII...

...and prompts many questions as to why it is being done - and for whose benefit?

Locally, we have inflation, retail sales and and interest rate decision, but it seems the that the markets will be driven by the larger concerns abroad.

This ride is not over any manner of means

Please manage your risks wisely!

To give you a little helping hand, feel free to take our Rand forecasting service for a test-drive!

This will give you access to the same charts we are to give us and our clients the likely direction of the Rand - ahead of time, enabling you to make educated and informed decision.

Simply use the link below to get access now.

This will give you access to the same charts we are to give us and our clients the likely direction of the Rand - ahead of time, enabling you to make educated and informed decision.

No charge. No card. All yours to trial for 14 days.

If you have any questions or feedback, please leave them below.

To your success~

James Paynter

P.S. Worrying about how to in manage your Rand exposures this year? Email me or give me a call on (041) 373-6310 or (087) 551 2848 - we would love to help.

P.S. Enjoyed this Weekly Rand Review? Click here to get our Weekly Rand Rev