Eish! What a week!

The South African Rand faced a whirlwind of challenges, with global trade tensions escalating sharply due to new U.S. tariffs...

...triggering widespread stock market crashes (which we have been anticipating for some time) - and sending shockwaves across financial markets.

Domestically, political strains added to the uncertainty, leaving the Rand battered and bruised as it slid by a full 100 cents to levels not seen in many months.

Let's dive into some of the moments that shaped our turbulent journey.

Market Pulse 📊

- Price Action: R18.21-19.21 range, with two days of 50c plus moves

- Technical Setup: Support R19.03/01,18.72, resistance R19.38, 19.64

- Momentum: Rand weakness bias overall, but volatile

Key Moments (31 Mar - 4 Apr 2025):

Some of the more critical factors affecting price action this week:

- Global Trade Tensions Escalate: U.S. President Donald Trump announced sweeping tariffs, including a 10% baseline on all imports and half of trade partners calculated tariffs.

- Domestic Political Strains: The GNU seems to be dying as the DA

announced that talks with the ANC had collapsed, raising political uncertainty. - Global Stock Markets Crash: The markets had one of their worst days in years on Friday, as markets reacted to newly announced US tariffs

The week kicked off with the Rand trading around 18.37 against the US dollar, with international markets jittery ahead of the impending US tariffs due to be announced on Wednesday.

Despite this, the Rand managed to hold its own and in fact strengthened, hitting R18.22/$ before closing at a bit higher at 18.29 to the USD.

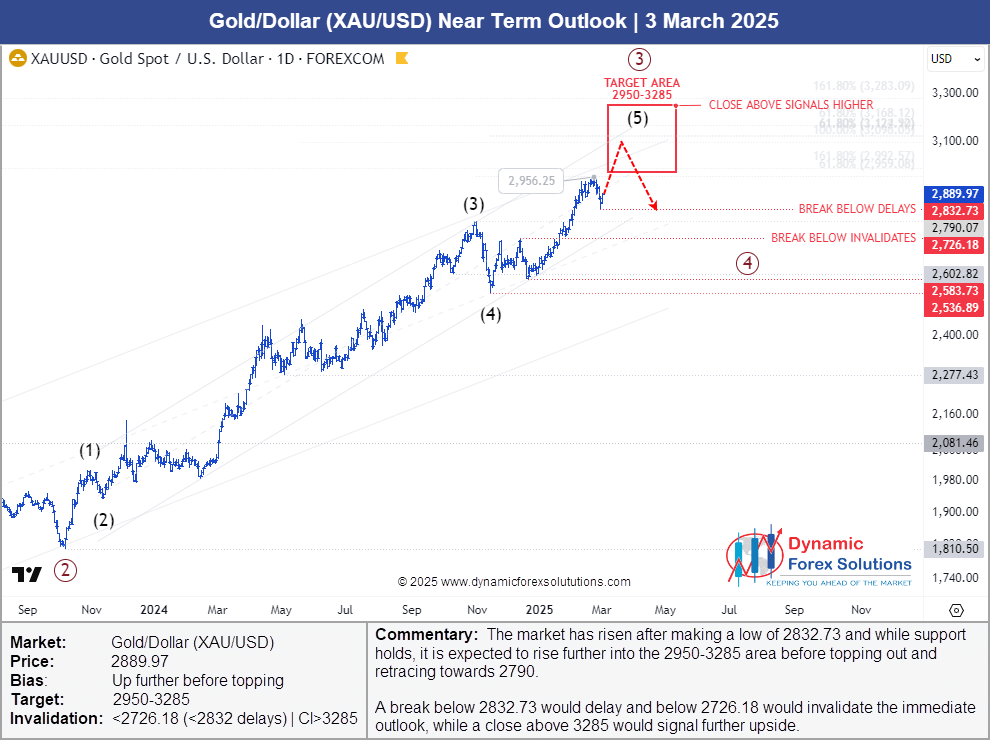

But based on our updated analysis, this was merely a retracement, and we were anticipating more upside into at least the 18.50-18.72 area over the next few days, with a break above here signaling higher (see below).

(click to enlarge)

And if you had been privy to our longer-term outlook issued in late January, you would have noticed we were expecting a move even higher up into the 19.38 to 19.91 area over the coming weeks...

(click to enlarge)

...in other words, we were expecting some fireworks.

And it seemed all that was needed was a trigger, which it seems was now on the cards!.

And it didn't take long, as market sentiment soured on Tuesday as whispers became louder regarding Trump's imminent tariff announcement and the implications for global trade and international relations.

The Rand started to lose ground, testing above R18.50 before closing at R18.44/$, with anxiety clearly spreading across global markets.

And then came Wednesday (which Trump had dubbed 'Liberation Day') and the nervousness increased as the impending tariffs approached, with the Rand breaking above R18.70/$ as the markets hedged their bets.

And when it came, it was still a shock, but not as bad as it could have been.

While the White House had been talking about full reciprocal tariffs, what Trump announced was instead:

a minimum of 10% tariff

a tariff equal to half the calculated tariff imposed by countries on US exports

...which for South Africa still came in at a substantial 30%, though less than some other nations.

Nevertheless, the markets reacted violently, and Rand was not immune, with the USDZAR jumping to hit a high of R18.87/$ as major stock indices worldwide fell sharply amid heightened investor caution - and fear of a larger-scale tariff war.

And in other news...

US Tariffs, Trade Deficits and Retaliatory Measures

While there has been much said about US-imposed tariffs, let's perhaps put this in perspective:

Just as a company cannot survive if its sales value is less than its cost of sales, so a country cannot survive with an ongoing and increasing trade deficit.

It is unsustainable!

Yet, that is exactly what has been happening for decades, as one after another US administration have allowed imports from other countries with virtually no tariffs, while the nations that have enjoyed access to this massive market have imposed huge tariffs on US goods.

The result: A massive national debt of 37 trillion dollars!

It has come to the point where interest on this debt is now approaching a trillion dollars - more than what is spent on defence!

Something had to be done to turn this lunacy around...

...and it has needed some bold moves and decisions to do so!

1. Cutting government expense with DOGE was the first step.

2. Correcting the trade imbalances was the next.

I think we can safely say that the days of the proverbial can being kicked down the road are now officially over...

...and there is no going back!

But where is this going to end - in a feared tariff war?

It seems like China thinks so, as it swiftly imposed retaliatory tariffs on American goods, intensifying fears of a global trade war.

But we do not share this fear.

Many countries know that they have been taking advantage of the US for decades and realize the status quo has ended - but they still need the US for trade...

The result being that many leaders now coming to the table to reduce or eliminate their own tariffs to allow more free trade...

...and many companies are returning their manufacturing to the US to enjoy the promised tax breaks and free access to the American market.

Seems to me like some common sense (and business sense) is being injected into the global trade relations at last!

Europe's Political Status Quo Under Threat

While there is a general bringing back of common sense across the ocean, up north European nations seem hellbent on continuing down their failing globalist roadmap...

...with the latest being the news that Marine Le Pen, the conservative anti-immigration front-runner for France's presidential elections in 2027, was found guilty of embezzlement and sentenced to four years in prison, effectively derailing her presidential ambitions...

...sounds ominously like what was happening across the pond in the run-up to the US elections, doesn't it?

Coming off the back of Romania having their elections cancelled due to conservative candidates gaining popularity, this is a disturbing pattern across Europe and beyond (think Pakistan, Brazil, Canada for example)...

...where nations that publicly advocate democracy seem to increasingly be adopting authoritarian practices.

Notably, these nations continued and unwavering support for Ukraine - despite Zelensky having eliminated opposition parties, silenced independent media, clamped down on free speech and cancelled elections - seems to further underscore the alarming shift in recent years toward actions that contradict professed values.

European leaders were unimpressed with U.S. Vice President Vance's speech in February warning that their danger was not from outside Europe, but from within...

...as he warned them of the dangers of moving away from traditionally shared values, and highlighted the dangers of silencing opposition and free speech - a feature of totalitarianism - not democracy.

Despite their outrage, it now seems they are going out their way to prove him right!

(click to enlarge)

Want to see where the Dollar, Euro, Gold & Bitcoin are expected to go?

Get our latest predictions here - 7 DAY FREE TRIAL

Getting back to the Rand...

Thursday seemed very nervous as the markets digested the announced US tariffs, sending shockwaves through the financial world, with US markets dropping sharply below lows of recent weeks, signalling more downside was imminent.

Domestically, the DA's resistance to the fiscal framework and an announcement that talks with the ANC had collapsed deepened fears of instability within the coalition government.

These combined factors pushed the Rand briefly past the psychological barrier of R19.01/$, marking a significant deterioration in confidence...

...but somehow it managed to regain some composure and managed to regain 30c by the close.

Friday came - and it was a bloodbath from the get-go!

Stock markets tumbled the world over, with the JSE losing over 6% on the day!

The Rand was caught in the whirlwind and pushed above R19 to test R19.11/$ before the lunchtime bell had even rung.

And then came the US Non-Farm Payrolls (NFP) report, which showed much stronger-than-expected job growth, intensifying fears of prolonged high interest rates and further bolstering the US dollar at the Rand's expense, pushing the Rand to R19.21/$...

...a full 100 cents from Monday's low - a 5.4% loss in value!

And in so doing, validated our forecast of the previous week, and was coming close to doing so on our longer term predictions.

Somehow the Rand managed to claw back from these levels before the close to end the week around R19.05/$ rather battered and bruised!

It was one of the more notable weeks we have had in 2025...

...in a year that is proving to be an ongoing rollercoaster!

Let's put this one into numbers!

Volatility & Risk Analysis

Massive volatility on a daily and weekly basis, with no day under 1.2% move and Wednesday just pipping Friday with a 56c (3%) move :

- Average Daily Range: 38c or 2.1%

This equates to a potential profit or loss of R21,000 every day for every R1 million exposure - with Wednesday being R30,000 - Weekly Range (total fluctuation): 100c or 5.4%...

...equating to a saving or loss of R54,000 for every R1 million exposure simply by taking action at the right or wrong time!

These are numbers that can give you a windfall...

...or wipe out any profit margins - plus some!

Which highlights the need for not flying by the seat of your pants in times like these!

You need an understanding of how the markets work and why you need an objective view (like our charts above) to help you make the right decision at the right time!

The question is:- Did you manage to take action in time?

Want to understand how the market actually works

- and how to use this to advantage?

Download your

"Unpuzzling the Rand eBook" HERE ⇨

The Week Ahead

Looking forward to the new week, while there may be triggers in terms of economic data, the overriding drivers will be the stock markets, how the trade negotiations work out to mitigate US tariff impacts, and the developing rifts between the DA and the ANC.

We expect a rough ride in the coming weeks...

...and staying informed and agile will be crucial in navigating the uncertainties ahead.

Where does this leave the Rand?

We see it remaining under pressure and fully expect to see it closing in on all-time highs.

As always, while economists are looking for reasons why the market has moved, we will instead use our forward-looking forecast modelling to give us a much-needed unemotional and objective view of where the market is likely to head...

...an essential instrument to offset our natural emotional decision-making - especially in times like these!

To give you a little helping hand, feel free to take our Rand forecasting service for a test-drive!

This will give you access to the same charts that help guide us and our clients with the likely direction of the Rand - ahead of time, enabling us to make educated and informed decisions.

Simply use the link below to get access now.

No charge. No card. All yours to try out for 14 days.

If you have any questions or feedback, please leave them below.

To your success~

James Paynter

P.S. Worrying about how to in manage your Rand exposures this year? Email me or give me a call on (041) 373-6310 or (087) 551 2848 - we would love to help.

P.S. Enjoyed this Weekly Rand Review? Click here to get our Weekly Rand Rev