Another frantic week of market activity has passed us by, as 2021 market activity promises to be just as tumultuous (if not more so, based on our predictions) as 2020...

And this this time was the turn of the Rand to forge a comeback against the Dollar, after huge losses.

As the ebb and flow of markets continued...

Global news continued to dominate the headlines, with the end of Trump's 4 year term approaching.

There is a lot to cover, so let's get into the full review...

Firstly, we released our next US Dollar vs Rand update on Friday the 8th, before the week began. With the Rand at R15.28, we were expecting to see a push higher into the R15.55-16.08 area before we would then see the market top out, and move back down lower. (see below - click to enlarge)

We were due for another humdinger if this was to be accurate!

The week had plenty going on, and here were the biggest talking points:

- Trump's Impeachment #2 - a hastily arranged vote in the house following the mob invasion of the Capitol meant that Trump became the first President ever to be impeached twice.

- US Stimulus - Biden revealed a massive package that he intends the pass the day he gets into office...how will this affect markets?

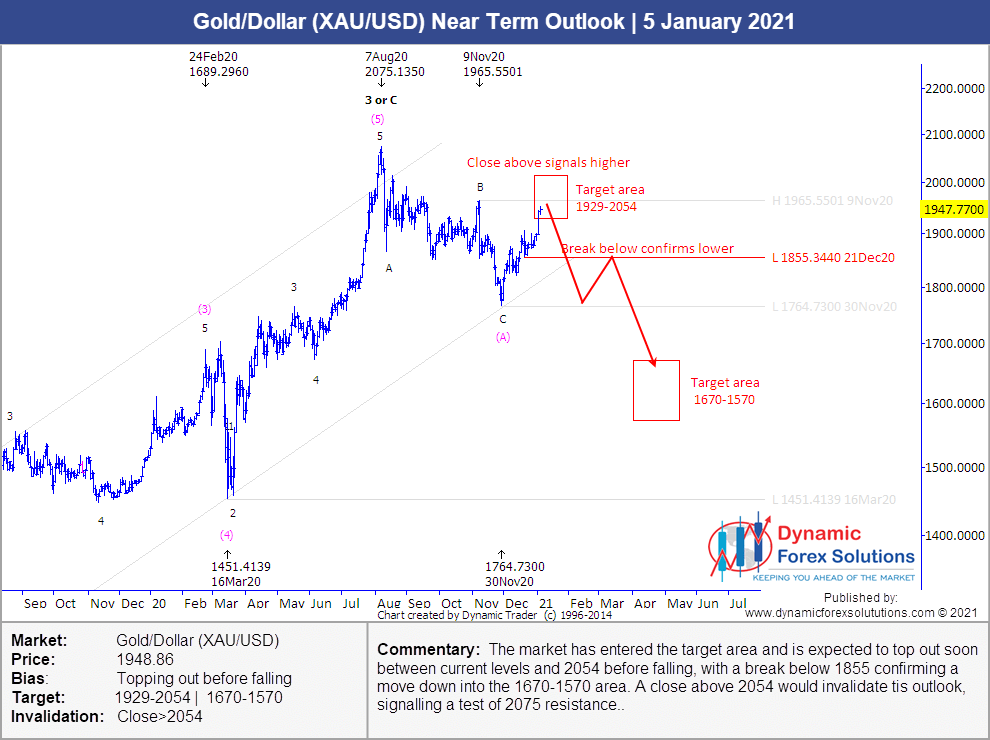

- Gold's Collapse - after pushing to test near $2000, the safe haven has had a torrid time the last 2 weeks...could you have seen this coming?

- Multiple Government Crises - crises not only in the US, but in Europe and Middle East as resignations result in near collapse.

- Trump Declassifies - Trump proceeds to declassify a mass of information, shedding light on the Obama administration's surveillance and espionage committed against the 2016 Trump campaign.

And the week had gotten off to a bang by the time most had not even got into the office!

Before 8am, the Rand had breached R15.50.

By mid afternoon, it was testing toward R15.70, touching as high as R15.66.

This meant we were right into the middle of our target area, and a reversal was imminent...

...and right on cue, it came as per our Elliott Wave based forecasting system, as the market collapsed lower to R15.15 by late Tuesday trade.

Sometimes the precision of the Elliott Wave and our other indicators leaves us amazed too - this was one of those days!

In amongst the frantic news, market activity and more, it had called this perfectly...

Over the weekend, Trump was all over the headlines again as Democrats moved forward very fast to hold an impeachment vote before his term in office ended.

Big Tech companies set a dangerous precedent in blocking Trump from their platforms - Twitter, Facebook, Instagram and similar companies all united in the decision in distancing themselves from the President - and following this up by removing many Trump supporters from their platforms.

This is the kind of censorship that is consistent with a communist agenda, not a social media platform in a democracy - and is an ominous sign indeed with this being in the hands of a few. But Big Tech may well have shot themselves in the foot, which has started with a mass exodus off their platforms...

And then the impeachment hearings. Before any investigation was completed or all the facts established, the House went ahead and voted to impeach him for insurrection and incitement of violence (this now goes to the Senate - which will only begin the debate after Biden is supposed to be inaugurated).

In addition, a state of emergency has been declared in Washington DC with tens of thousands of troops being deployed there ahead of the planned inauguration against possible unrest (for what is expected to be a low-key event?)

It seems January is not going to slow down anytime soon!

And then in other news, we had some other big events:

- The US Stimulus Package #3 is now the biggest talking point as we head into the second half of January, with Biden unveiling his plan just a few days before his planned inauguration. The $1.9 trillion package promises to be the biggest in US history, with more stimulus cheques, unemployment aid, state & local government aid, and much more. All very well, but the amount of debt that the US is taking on promises to plague the country for years to come. For now, the markets see this as positive...but for how long?

- Staying in the US, figures released Thursday suggested the US labour market continues to struggle (obviously desperate for that stimulus), with the number of workers claiming unemployment benefits in the last week rising by 965K (forecasted 795K). The pandemic fight is far from over.|

- Problems were not just in the US, as governments in Europe and the Middle East entered crisis mode as resignations left governments in Italy, Netherlands, Estonia and Kuwait in a state collapse.

- Gold was one of the stalwarts which has flourished in 2020, pushing to record levels. However, in the last couple of weeks, there has been a massive wobble in the market despite the volatility - which should push investors to safe havens. Yet, the irrational market has done the exact opposite, leaving investors frustrated and confused. Well, for our subscribers, this did not come as a surprise, after our update on 6th of January called this move perfectly. (see below - click to enlarge)

To get a picture on where Gold is going for the rest of this year, take a look at our Global Forecasts Package here

P.S. We do Bitcoin vs US Dollar, Euro vs US Dollar and the Dollar Index too in the same package 🙂

Locally, focus will start shifting to next week’s SARB interest rate decision, with the MPC expected to keep rates unchanged to support the struggling local economy, perhaps even for the duration of 2021. However, there is growing support for a 25 basis point cut that many feel is the “magic pill” the SA economy needs.

And then to end of the week, came the announcement that President Trump had declassified a foot high amount of documentation including shedding light on the Obama administration's surveillance and espionage committed against the 2016 Trump campaign, which will likely open a can of worms.

And with that, we saw the local currency test down toward R15.02, before bouncing back up again to R15.30 on Friday afternoon.

The volatile Rand continues...and don't expect it to end anytime soon!

The Week Ahead (18-22 January 2021) |

As we look to the week ahead, apart from all of the other points we have discussed, these are the events to watch for:

- USA - Biden Inauguration, Trump Impeachment Trial, GDP Figures

- SA - Inflation Rate, Retail Sales, Interest Rate Decision

- UK & EU - Consumer Price Index, ECB Interest & Deposit Rate Decision, ECB Monetary Policy Statement

The big one here will obviously be the lead up to Biden's inauguration on the 20th, with many things going on in front and behind the scenes. Does Trump have any cards left up his sleeve?

Just perhaps...

Bottomline: Expect a week of significant volatility.

Our Elliott Wave based forecasting system has served us well in calling the recent lows and we will continue to look to it to give us direction for the days, weeks and months ahead.

Please take our Rand forecasting service for a test-drive!

This will give you access to the same charts we are to give us and our clients the likely direction of the Rand - ahead of time, enabling you to make educated and informed decision.

Simply use the link below to get access now. No charge. No card. All yours to trial for 14 days.

(You don't want to regret not having done so this time next week...)

Look forward to hearing from you.

To your success~

James Paynter